Economist warns ‘too many people long Bitcoin,’ will end up disappointed

Although Bitcoin (BTC) has recently grown its price to a new all-time high (ATH) and continues to trade above the psychologically important level at $70,000, some influential figures remain highly skeptical of the flagship decentralized finance (DeFi) asset, including American economist Peter Schiff.

Specifically, the famous Bitcoin naysayer strongly believes that too many individuals are confident in the future price increase of the maiden cryptocurrency and hold on to their long positions in it, but may end up disappointed, according to his X post on April 12.

Bitcoin vs. gold

Furthermore, in response to commenter CryptoAmericanBully who referred to gold, Schiff’s favorite asset, as a “pet rock” and “useless,” the economist stated that “Bitcoin has far more in common with a pet rock than gold does, though the pet rock has more utility than Bitcoin.”

Picks for you

As a reminder, the gold enthusiast has previously bashed the largest crypto, which has increased in price by nearly 70% this year alone, as a “fake asset,” and urged his followers on social media to sell all their Bitcoin and go buy some gold and silver via his website before it’s too late.

More recently, he also slammed the Bitcoin rally as an “overnight pump” that meant to “sucker [exchange-traded fund (ETF)] investors into buying the gap up,” as well as arguing that “Bitcoin ETFs have been a godsend for foreign central banks,” as they “siphoned investor demand away from gold.”

Bitcoin price prediction

It is also worth noting that, opposite of Schiff is an influential investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, who is highly bullish on the digital asset, agreeing with Cathie Wood, the founder and CEO of ARK Invest, in her prognosis of Bitcoin at $2.3 million.

At the same time, crypto trading experts like Ali Martinez are somewhat less optimistic regarding Bitcoin’s price, at least in the short-term, arguing that it has surpassed a critical resistance level and is looking at an imminent breakout that could culminate with an $85,000 price peak, as Finbold reported on April 8.

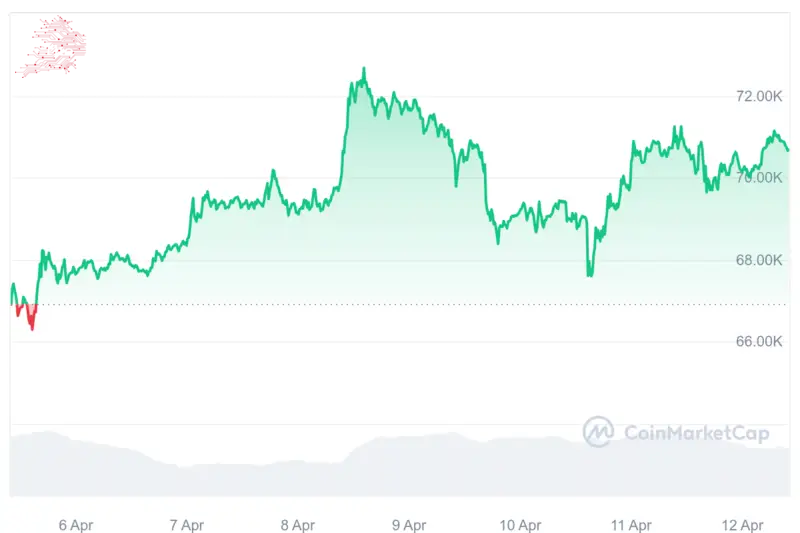

Meanwhile, the largest asset in the crypto sector was at press time trading at $70,672, recording a slight decline of 0.10% on the day, gaining 5.30% across the previous week, and losing 2.77% on its monthly chart, according to the most recent price data on April 12.

All things considered, making a definite BTC price prediction is a challenging task, which makes forecasts like those by Peter Schiff all the more unreliable, particularly in the face of the numerous Bitcoin enthusiasts and outside observers who firmly believe in Bitcoin’s future success.

That said, regardless of what any of these renowned individuals might predict, it is critical to carry out one’s own detailed research and carefully weigh all the risks before investing a significant amount of money into any asset, be it cryptocurrencies, stocks, or anything else.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Comments

Post a Comment