3 cryptocurrencies to use for efficient remittances worldwide

A growing trend in finance known as remittances is described by the International Monetary Fund (IMF) as the sum of two main components involving financial transactions across borders: “Compensation of employees” and “personal transfers”. However, it can also often describe migrants sending money to their origin country.

Due to technological innovations and the current global landscape, remittances have grown in volume in the last few years, attracting researchers, entrepreneurs, fintech, payment providers, government agencies, bankers, and other relevant entities worldwide. Which includes the cryptocurrency market.

Interestingly, data retrieved by Finbold from KNOMAD on October 4, shows that over $840 billion were already sent as remittances in a still going 2023. This volume is already bigger than the $831 billion transacted in 2022, which was 40 billion dollars higher than 2021’s $791 billion.

Additionally, a press release by the World Bank from June 2023 forecasted a growth of 1.4% in remittances to developing countries until the end of the year, despite seeing it as a “soften” in the “economic activity” for low- and middle-income countries (LMICs).

Cryptocurrencies that can be used for efficient remittances

In this context, cryptocurrencies can offer an efficient and viable solution for this growing demand for remittances worldwide. Borderless supranational currencies compete with each other for their share of adoption, in order to help people sending money abroad.

With that in mind, Finbold collated three cryptocurrencies that can be efficiently used for international payments and remittances. The list below is ordered by market capitalization:

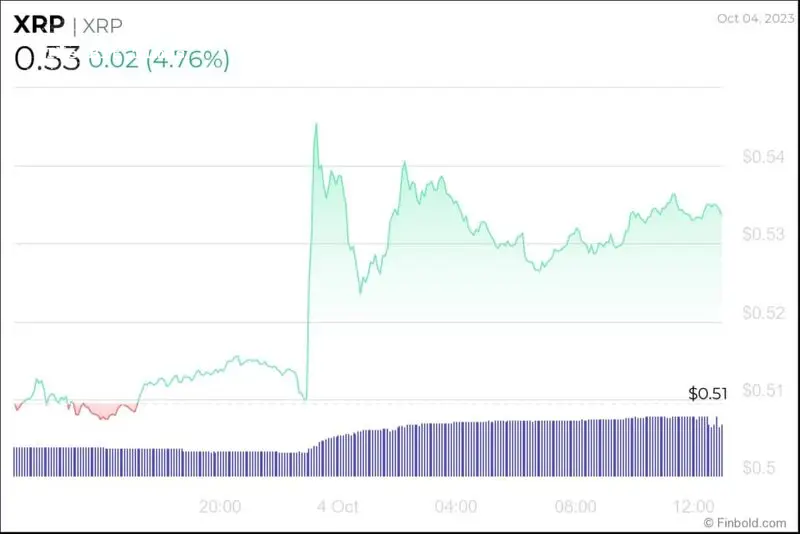

XRP (XRP)

XRP is a payment-focused token created by Ripple, with the goal of being the leading international settlement asset for retail and financial institutions. It sits at the fifth position by market cap, with over $28.44 billion of capitalization, considering the current 53.31 billion XRP in circulation at a price of $0.53 per token, by press time.

As for remittances, XRP can offer a viable solution with $0.0002 fees per transaction, and international settlement in 3 to 5 seconds. Partnerships with global banks also highlight XRP for the given use case.

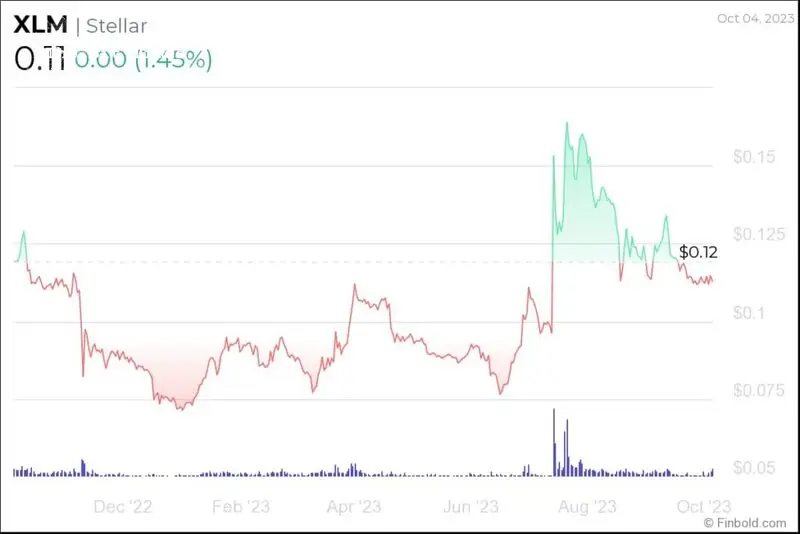

Stellar Lumens (XLM)

Lumens, or just XLM, is the native token for the Stellar Network, which was founded in 2015 by the co-founder and former contributor of Ripple, Jed McCaleb – who was also the creator of the centralized exchange Mt. Gox, a victim of one of the largest hacks in the crypto history.

Stellar is among the top 30 cryptocurrencies with a $3 billion market cap, traded by $0.11 at the time of publication, with a growing circulating supply of 27.76 billion XLM. Mainly known for having one of the lowest transaction fees and fastest settlement time — similar to XRP — Stellar can be efficiently used for remittances.

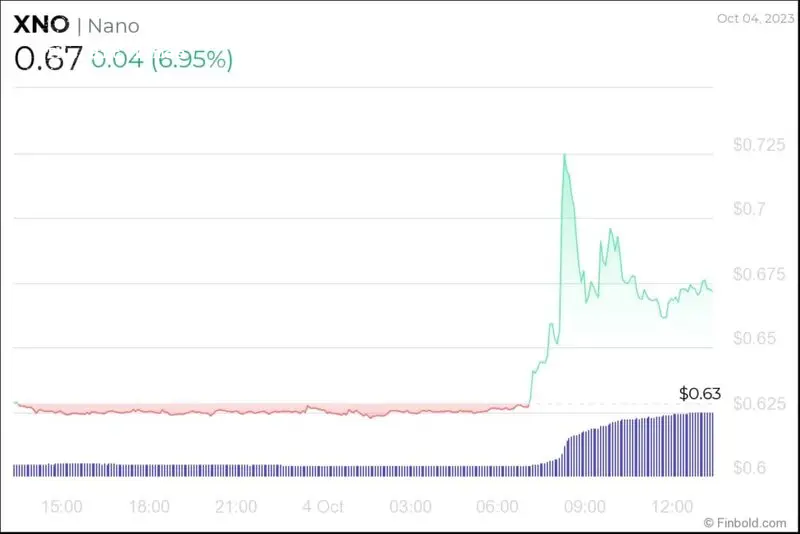

Nano (XNO)

Despite having a relatively low market cap of $90 million with a fully distributed and circulating supply of 133.24 million XNO, changing hands at $0.67 per unit by press time, Nano offers the most objectively efficient solution for remittances — considering the network charges no fees from its users, being able to settle transactions in 500ms in average.

Moreover, XNO is a digital money open-source software designed exclusively to be a simple and efficient means of exchange or payments. It has been kept by a decentralized network for eight years, since its launch on October 4, 2015.

Comments

Post a Comment