Checkout Friction May Lose Online Retailers 50% Of Their Sales

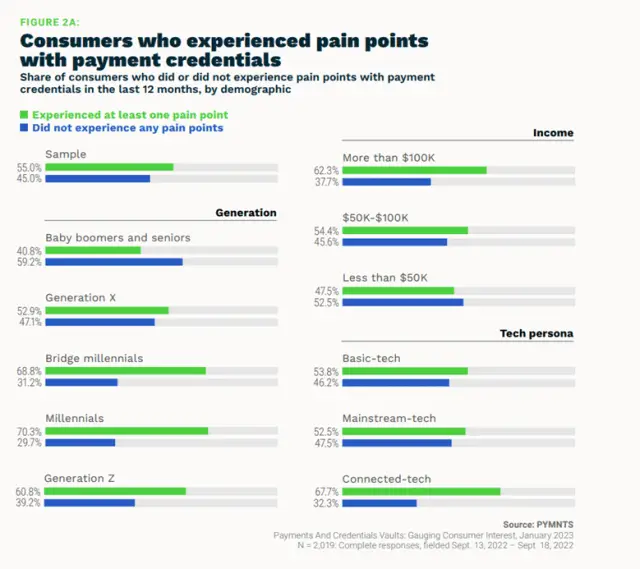

Fifty-five percent of customers claim that checkout friction is so annoying that it causes them to abandon a transaction in the middle of it.

Any eCommerce site, but notably small firms operating on slim profit margins, might see a considerable portion of lost income as a result of that possible missed opportunity.

The ability to hold payment data is no longer a perk; it is now expected as online retailers develop their capacities to meet consumer expectations for a seamless experience.

To attain a quicker, more efficient checkout process, 80% of consumers keep their payment information online across different merchant websites or apps, according to “Payments and Credentials Vaults: Gauging Customer Interest,” a PYMNTS and FIS partnership.

This implies that there is a greater chance that customers will notice when checkout friction happens, which is typically caused by out-of-date payment information or data theft.

Businesses could be apprehensive about changing their checkout procedure to accept saved payment methods. This can be because of financial restrictions or worry about implementation difficulties. However, there are third-party options accessible, like biometrics and authorization optimization. Such solutions speed up merchant adoption while lowering revenue loss at the point of sale.

Adyen, a FinTech company focusing on corporate payments, is now providing a solution for the authorization friction caused by cached credentials. Adyen is helping merchants to increase authorization rates from card-on-file payments by automatically updating Visa accounts to lower unintentional churn by distributing the Real-Time Visa Account Updater to European businesses.

A payment and credentials vault, which saves and encrypts payment information through a secure app that can be used for numerous shops, is another option that retailers may consider.

40% of customers who were polled are very or highly interested in using a vault, and two-thirds are at least somewhat receptive to the idea. Customers who link to a credentials vault are more likely than not 58% more likely to transfer merchants. Given that it would address the needs of both consumers and retailers, this is the most straightforward approach to implement.

Retailers need to reduce checkout friction — whether they update systems through third parties or manage it on their own — as customers become pickier about where they spend their money and less tolerant of pain spots when shopping.

Comments

Post a Comment